Taxes & Revenue Sources

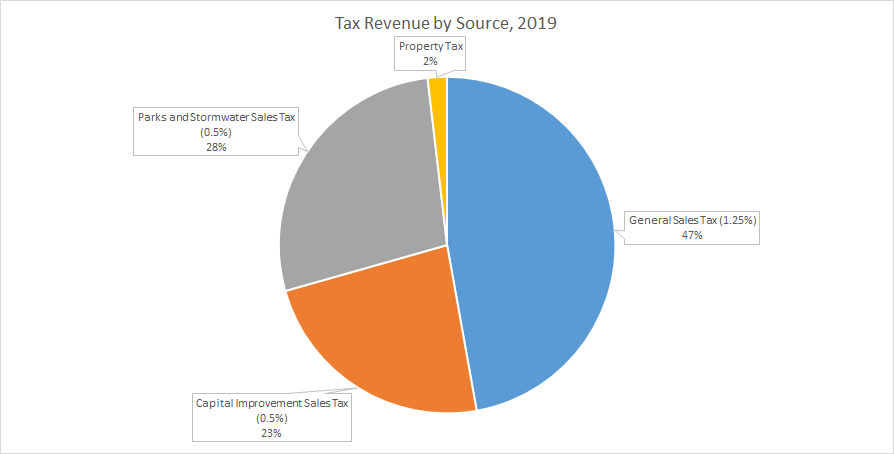

Taxes

- Sales Tax (1%)

- Capital Improvements Tax (.50%)

- Park and Stormwater Tax (.50%)

- Additional Sales Tax (.25%)

- Commercial Property Tax ($0.385 per $100 assessed valuation, 2019)

Other Sources of Revenue

- Utility Gross Receipt Taxes

- Intergovernmental Revenue

- Licensing and Permits

- State, Federal and Local Grants

- Miscellaneous Revenue

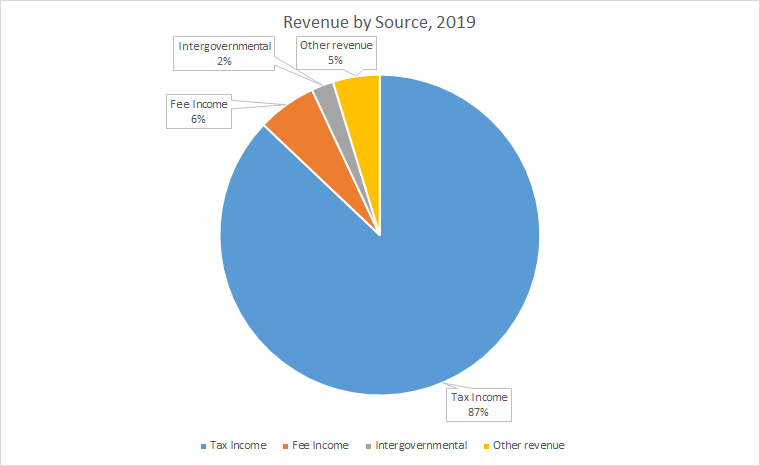

Revenue Breakdown

Tax Income: Sales/use tax, commercial property tax, etc.

Fee Income: All permit fees, residential sewer lateral program, business/liquor licensing, cell tower lease

Intergovernmental: Motor vehicle taxes, utility franchise fees, cigarette taxes

Other revenue: Accrued interest and miscellaneous income.

At this time, the City is contracted with St. Louis County and we receive no income associated with traffic court fines/fees.